- hayleybaxter9

- Jun 24

- 2 min read

Budgeting doesn’t have to be overwhelming or restrictive. In fact, with a few simple adjustments, it can empower you to take control of your finances and finally start saving. Here are 10 easy-to-implement budgeting hacks that will help you save money, stress less, and stay organized.

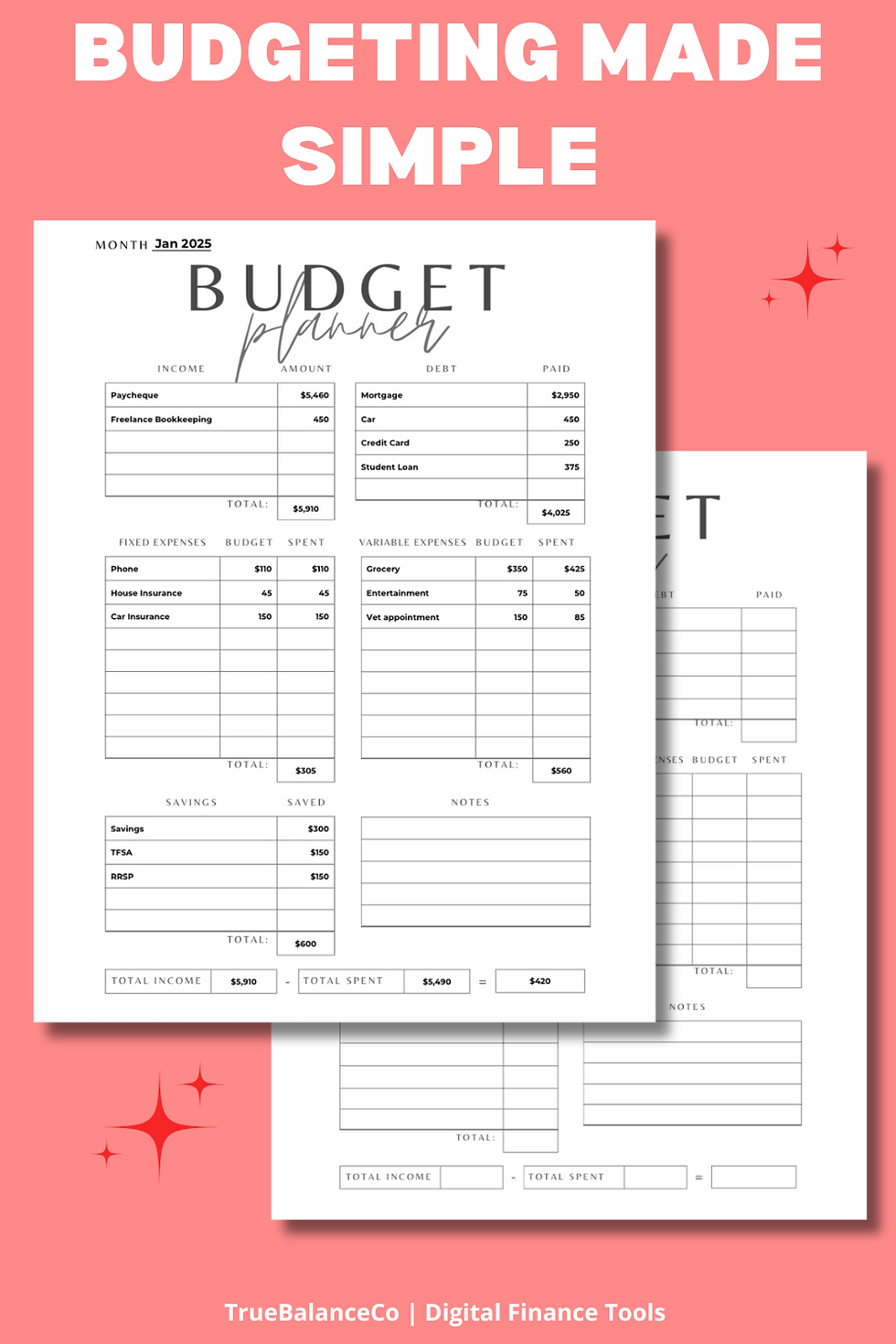

1. Start with a Budgeting Planner - Using a printable budgeting planner helps you visually organize your income, expenses, and goals. It keeps you accountable and prevents impulse spending.

Check out these printable budgeting planners!

2. Use the 50/30/20 Rule - Divide your income: 50% to needs, 30% to wants, 20% to savings or debt. This simple formula gives structure without being too strict.

3. Automate Savings - Set up automatic transfers to your savings account right after payday. What you don’t see, you won’t spend.

Check out these savings trackers!

4. Track Expenses Weekly - Don’t wait until the end of the month. Use a printable expense tracker to review your weekly spending and adjust in real time.

5. Meal Plan and Grocery List - Plan your meals weekly and stick to a grocery list. This avoids food waste and reduces the temptation to order takeout.

6. Use Cashback & Reward Apps - Use apps like Rakuten, Honey, or your credit card rewards program to earn while you shop. It adds up fast.

7. Declutter Subscriptions - Audit your monthly subscriptions and cancel anything unused. That $12 streaming service adds up over time.

8. Use Cash Envelopes - Designate cash for specific categories (like groceries, gas, or fun). Once it’s gone, it’s gone.

9. Set Mini Savings Goals - Instead of aiming for $5,000 all at once, break it into $250 chunks. It feels more manageable and motivating.

10. Review & Adjust Monthly Budgeting is flexible. Review your budget monthly and make changes based on your life changes or unexpected expenses.

Related Posts:

Join the TrueBalanceCo Community Sign up for more budgeting tips, free printables, and money-saving inspiration.